Theакрилонитрилөнөр жай 2022-жылы кубаттуулукту бошотуу циклин баштады, кубаттуулугу жылына 10% дан ашык өсүп, камсыздоо басымын жогорулатты. Ошол эле учурда, биз суроо-талап жагы эпидемияга байланыштуу болушу керек эле жакшы эмес экенин көрүп жатабыз жана өнөр жай ылдыйлоо тенденциясы үстөмдүк кылып, жаркыраган тактарды табуу кыйын.

Маалымат булагы: Goldlink

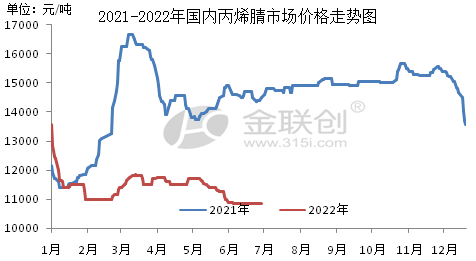

Ата мекендик акрилонитрил рыногу 2022-жылдын биринчи жарымында биринчи төмөндөөнү көрсөттү, андан кийин термелүүнүн кеңири диапазону үстөмдүк кылды. Мисал катары Чыгыш Кытай рыногун ала турган болсок, 2022-жылдын биринчи жарымында орточо баа 11,455 RMB/тонна болуп, 21,29% төмөндөп, январь айында болгон эң жогорку баа 13,100 RMB/тонна жана эң төмөнкү чеки 10,800 RMB/тонна, июнь айында болгон.

рынокко таасир этүүчү негизги факторлор болуп саналат.

I. Сунуштун көбөйүшү. 2022-жыл дагы эле концентрацияланган ата мекендик акрилонитрил экспансиясынын жылы болуп саналат, анын ичинде Лихуа Йи 260 000 тонна/жылына жана Тяньчен Цицян 130 000 тонна/жылына жалпы кубаттуулугу 390 000 тонна акрилонитрил заводун ишке киргизүү. Экспорттун көлөмү январдан майга чейин жылдык 12,1% өскөнүнө карабастан, суроо-талап жана сунуш дагы эле эркин өнүккөн.

Экинчиден, эпидемиянын кайталанышы заводдун запастарына басымдын күчөшүнө алып келди. 2022-жылга киргенден бери ал ар дайым ашыкча сунуш стадиясында болгон, биринчи чейректин аягында ачылган эпидемиянын таасиринен кийин ишканалар жана социалдык инвентаризация тездетилген топтолгон, Чыгыш Кытайда жана Шандунгда логистика негизинен токтоп калган, ошондой эле ылдыйкы агымдын кыскаруусу жана жабылышынын чоң аймагы болгон, суроо-талаптын алсырашы, күчөгөн факторлордун басымы күчөгөн. бааны көтөрүү саясатын кыскартуу.

Үчүнчүдөн, төмөнкү өнөр жай суроо-талаптын өсүшү чектелген. 2022-жылдын биринчи жарымында 150 000 тонна жаңы LG Huizhou заводу ABSге кошулуп, жылына 37 500 тонна акрилонитрил чийки затын колдонгон, ошондуктан ылдыйкы кубаттуулуктун өсүшү чийки заттын өсүшүнөн азыраак, ошондуктан акрилонитрил заводдорунун орточо ачылышы 2022-жылдын биринчи жарымында 80% га жакын экенин көрсөтүп турат.

2022-жылдын экинчи жарымында Кытайдын акрилонитрил рыногу төмөн деңгээлдеги термелүү тенденциясын улантат жана жалпы жөнгө салуу мейкиндиги салыштырмалуу чектелген. Мындан тышкары, акрилонитрилдин жаңы өндүрүштүк кубаттуулугу жылдын экинчи жарымында олуттуу өстү, ал эми берилген товарлардын көлөмү дагы өсүшү мүмкүн. Бирок, ылдый агымда гана ABS жаңы түзмөктөр ишке киргизилиши күтүлүүдө, жалпы суроо-талап чектелүү, суроо-талап менен сунуштун ортосундагы дал келбегендиктен, акрилонитрилдин суроо-талаптын жана сунуштун карама-каршылыктары күчөй берет, заводдун ачылышы да кыйын болгондо, чоң кубаттуулуктагы ишканалар терс чараларды сатып алышат. acrylonitril негизинен наркы сызыгынын астында болгондуктан, дагы эле чийки зат пропилен тенденциясын буруу керек. Заводдон чыгарылган баалар (рыноктук баалар) негизги аймактарда 10,000-12,000 RMB/mt диапазонунда болушу күтүлүүдө, жогорку чекит, кыязы, август айында болот.

Кытайдын акрилонитрил рыногунда 2022-жылдын экинчи жарымында пропилен баанын өзгөрүшүнө негизги таасир этүүчү фактор болуп саналат. Жылдын экинчи жарымында өндүрүштүк кубаттуулуктарды олуттуу кеңейтүү алдын ала корутунду болгондуктан, экинчи жарымында баалардын олуттуу көтөрүлүү мүмкүнчүлүгүнө ээ болуу кыйын. Ошондуктан, чийки зат пропилен баасы acrylonitrile баасын аныктоо үчүн негизги фактор болуп калат. Эгерде пропилен 8000 RMB/mtга жакын турса, акрилонитрилдин төмөндөшү кыйын болот. Бирок, эгерде пропилендин баасы төмөндөө берсе, акрилонитрил баасы дагы эле ашыкча сунуштун басымы астында төмөндөө мүмкүнчүлүгүнө ээ болот.

2022-жылдан 2023-жылга чейин Кытай жылына 1,38 миллион тонна акрилонитрил заводдорун кошот, алардын көбү кайра иштетүүчү жана химиялык интеграцияланган колдоочу шаймандар, алар ишке киргизилиши ыктымал. Бирок, ылдый агымда гана ABS тез өнүгүп жатат, акрилдер жана акриламиддер жылуу абалда болгондуктан, сөзсүз түрдө ашыкча камсыз кылуу кырдаалын пайда кылат. Жакынкы үч жылда, акрилонитрилдин кубаттуулугун кеңейтүү менен, өнөр жайдын кирешеси төмөндөп, кээ бир жаңы орнотуулар кечигүүлөр жана текчелер мүмкүнчүлүгүнө туш болушу күтүлүүдө.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with port, wharf, airport and railway transportation network, and in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan in China, with chemical and dangerous chemical warehouses, with a year-round storage capacity of more than 50,000 tons of chemical raw materials, with sufficient supply of goods.chemwin E-mail: service@skychemwin.com whatsapp:19117288062 Phone:+86 4008620777 +86 19117288062

Посттун убактысы: 29-июнь-2022